Understanding Taxes and Tax Rules in PrestaShop

Sales tax is a complex subject. While this article will introduce you to the concepts of taxes and tax rules in PrestaShop, it is not intended to be an in depth explanation of how each shop owner handles sales taxes. It's best to set up your taxes and tax rules before you begin adding products so that you can apply taxes while you are creating your products.

When creating taxes and tax rules, make sure you are adhering to the tax laws of your country and locality. A good source of information about sales tax in the United States can be found on the Small Business Administration's website:

Collecting Sales Tax Over the Internet

Taxes in PrestaShop

Taxes are specific rates that are set for sales tax on your products. You can view the taxes that are automatically created (based on the country you selected during the installation process) by clicking on the Payment tab and then the Taxes link. It may be easier to understand the concept of Taxes and Tax Rules if you think of Taxes as what they actually are: tax rates.

Before we start creating any new taxes or editing any existing ones, we will want to have a full understanding of how Taxes and Tax Rules work together.

Tax Rules in PrestaShop

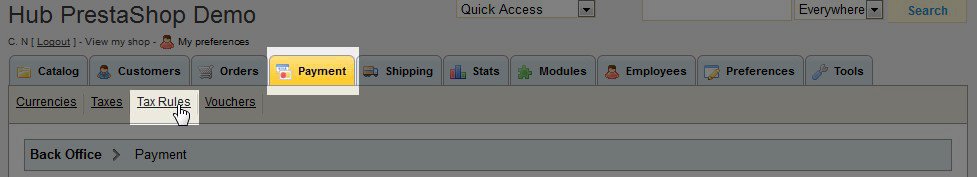

By default, PrestaShop applies a tax (tax rate) to all countries, states, and zones. Tax Rules control which taxes are applied to specific geographic areas. You can view the default Tax Rules (based on the country you selected during the PrestaShop install process) by clicking on the Tax Rules link under the Payment tab.

Now that you have a better understanding of what Taxes and Tax Rules are in PrestaShop, you can begin creating your own Taxes and Tax Rules or editing the existing ones installed by default.

Help Center Login

Setting up Taxes in PrestaShop

| 1. | Understanding Taxes and Tax Rules in PrestaShop |

| 2. | Setting Up a Tax in PrestaShop |

| 3. | Creating Tax Rules in PrestaShop |

| 4. | Configuring Tax Options in PrestaShop |

We value your feedback!

There is a step or detail missing from the instructions.

The information is incorrect or out-of-date.

It does not resolve the question/problem I have.

new! - Enter your name and email address above and we will post your feedback in the comments on this page!